Whether you’re a crypto expert or a Web3 curious, chances are, blockchain has touched your life in one way or another. Sure, you might not get all the technical bits but understanding the mechanics behind transaction types is becoming increasingly important, as this is the backbone for almost any type of data transaction today, especially when we talk about digital assets. Onchain and offchain transactions serve unique purposes and cater to specific needs. But what does this mean for users, or potential asset issuers? What are the benefits and considerations? Let’s dive in!

Understanding Digital Assets

Before we dive deeper, let’s clear up what digital assets mean. You’re probably familiar with physical assets, your house, car, or even that stack of discount coupons waiting to be used. Digital assets are essentially the virtual versions of these, think about having a digital coupon in a wallet on your phone that gets automatically applied when you make a purchase. It’s about having a digital footprint for your possessions that you can access and use anytime, anywhere, without the hassle of physical limitations.

The Strength of Onchain

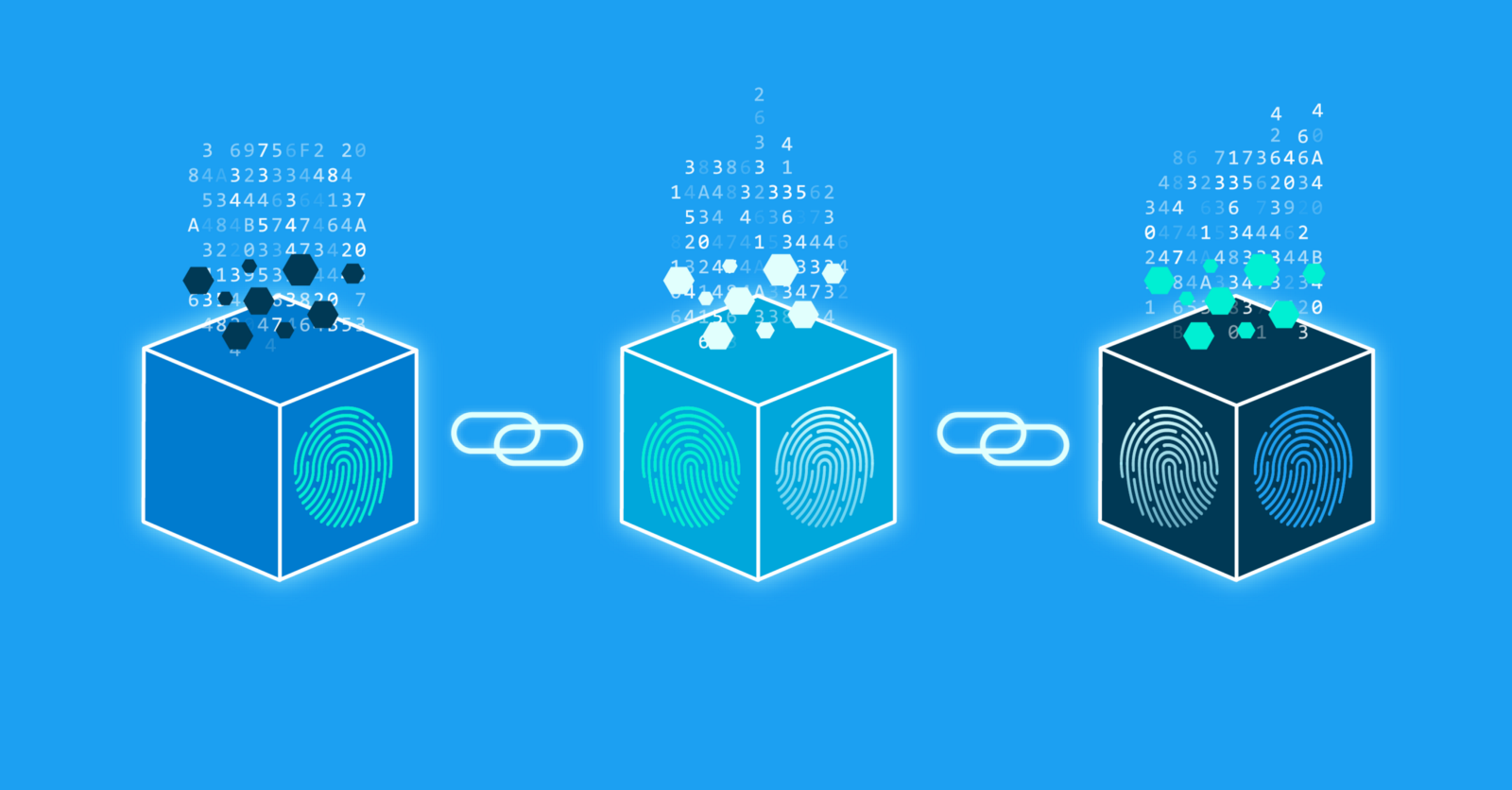

Moving digital assets onchain means they live on a blockchain rather than in a centralized database. They’re like the solid ground beneath your feet, offering a level of security and transparency that’s hard to beat. An onchain transaction is immutable, permanent, and visible for all to see. It’s beauty lies in their trustless nature. When you send a transaction onchain, it’s broadcasted to the entire network, going through a consensus process like Proof of Work (PoW) or Proof of Stake (PoS) to be validated and then permanently etched into the blockchain ledger. By operating on a decentralized and immutable ledger, these transactions cut out the middleman, offering a transparent and secure method for transferring assets. Sure, it might take a bit longer and cost a few extra cents, but it’s worth it for the peace of mind, right?

This isn’t just techie talk, it has genuine benefits for everyone involved:

- Security and Permanence: Onchain assets are pretty much set in stone; you can’t change or delete them easily, which means a higher level of security against fraud.

- Tougher to Hack: Thanks to blockchain being decentralized, it’s a lot harder for bad actors to compromise your digital assets.

- Your Data, Your Rules: With a decentralized system, you’re not handing over control of your data to some big corporation. It’s a step towards reclaiming privacy and control in the digital age.

Where Offchain Fits In

Now, don’t get me wrong. Offchain transactions have their charm. These transactions happen outside the main blockchain ledger, utilizing secondary networks or layers (Layer-2s) to facilitate the transfer of assets. The appeal of offchain transactions lies in their ability to offer instant execution, lower fees, and offchain transactions zoom outside the main blockchain, offering a swift way to handle those everyday, high-frequency tasks without clogging up the network. They’re essential for keeping things moving smoothly, especially when the blockchain gets a bit crowded. That said, not everything needs to be on the blockchain.

But Here’s the Thing…

While offchain solutions are fantastic for what they do, there’s something about the solidity and integrity of onchain transactions that just feels right, especially when we’re talking about something as nuanced as NFTs. And speaking of NFTs…

At reNFT, we didn’t just jump on the onchain bandwagon because it’s cool. We have a long journey of pioneering solutions and crafting onchain products that transform how digital ownership and accessibility are experienced, making it easier than ever to unlock the full potential of your digital assets. If you’re exploring NFT rentals, you most probably you’ll come across reNFT. We’re proud to be the first and leading rentals protocol in this space.

To Be Onchain or Not To Be?

The decision between onchain and offchain comes down to what’s best suited for the type of digital assets you’re dealing with and your specific needs. High-value, low-frequency assets like deeds or rare collectibles might find a secure home onchain, while everyday digital tokens like coupons or reward points may thrive offchain for their efficiency and accessibility.

Imagine a future where your digital assets, whether they’re game items, event tickets, or even the deed to your house, are as easy to use, trade, and secure as sending a text message. That’s the kind of world onchain technology is building. It’s about more than just owning something digitally, it’s about having the freedom to use and control it in ways we’re just starting to explore.

So, while the debate between onchain and offchain continues, with valid points on both sides, we’re excited about the possibilities that onchain holds for the future of digital assets. It’s about building a world where trust, transparency, and accessibility are not just ideals but realities. 🙌🏼